Equity Report Outlook|24 carat financial services | 22 September 2017

Equity tips:-

Sep 22 - Close

NIFTY:-

Nifty ends below 10K; Sensex down by 447 points

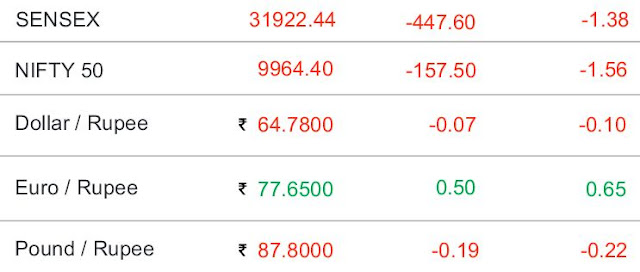

- Nifty ended at 9,964.4 level, down by 157.5 points, while Sensex closed at 31,922 level, down by 447 points on Friday. Nifty and Sensex witnessed biggest 10-day fall in the past 10 months. There were 207 advances, 1,464 declines and 290 unchanged stocks on NSE, reflecting strong negative sentiments floating in the market.

- Metal stocks witnessed strong downward movement. Nifty Metal index closed at 3,491.8 level, down by 4.04%. Hindalco was the top Nifty loser. The stock closed at Rs 232.7 per share, down by 4.85%. HCL Technologies was the top Nifty gainer, trading at Rs 882.9 per share, up by 1.45% or Rs 12.6 per share.

- In the broader markets, BSE Mid-cap index closed at 15,609 level, down by 2.71% while BSE Small-cap index closed at 16,293 level, down by 2.93%.

- Bank Nifty ended at 24,368 level, down by 430 points or 1.74%. Yes Bank was the top loser in the index closing at Rs 361.45 per share, down by Rs 15.6 per share or 4.14%. The index witnessed biggest intraday fall since November 21, 2016.

- BSE Realty index was the top losing index, which closed at 2,072.05 level, down by 4.29%. Indiabulls Real Estate was the top loser in the index ending at Rs 218 per share, down by 8.71%.

Index View-:

NIFTY:-

9,964.40 -157.50 (-1.56%)

Sep 22 - Close

| |

| NiftyTips |

- In Friday’s trading session Benchmark Indices Niy opened on a gap down note and traded with negave movement throughout the day. Niy ended at 9,964.4 level, down by 157.5 points, Niy witnessed biggest 10-day fall in the past 10 months reflecng strong negave senments floang in the market.

- Niy breached its major support levels of 10000 and closed below it on daily chart.

- Strong profit booking was seen in the market in most of the stocks from higher levels.

- we expect the index to gradually move towards 9950 – 9900, which is not far away from current levels. On the other hand, 10040 – 10080 would now be seen as a key resistance.

BANKNIFTY:-

24,368.85 -430.40 (-1.74%)Sep 22 - Close

|

| BankNifty |

- In Friday’s trading session Bank Niy index opened on gap down note & traded with negave movement throughout the day. Bank Niy ended at 24,368 level, down by 430 points or 1.74%. Yes Bank was the top loser in the index closing at Rs 361.45 per share, down by Rs 15.6 per share or 4.14%. The index witnessed biggest intraday fall since November 21, 2016.

- Bank Niy has breached its major support levels of 24500 and closed below it on daily chart.

- Bank Niy has given breakout of its up trend, trend line on daily chart.

- We expect the Niy Bank index to go down to 24200-24100. The short-term support for the Niy Bank index is placed around 24200 and 24100 whereas resistances are seen around 24500 and 24600.

Gainers/Loser:-

Top Gainers -Nifty 500 :-

Top Losers-Nifty 500 :-

Buzzing Stocks:-

Closing Bell:-

Closing Bell:-

Gainers: HCL Tech, Wipro (+1%).

Losers: Hindalco, Tata Steel (-5%).

PNB to raise up to Rs 5,000 Cr equity capital from the

markets to fund growth.

NMDC stock slips 5% on weakening of iron ore.

BHEL announces bonus share issue in the ratio of 1:2. Stock dips 2.5%.

Nifty Realty Index falls over 4%. Indiabulls Real Estate (-9%), DLF (-6%), Unitech,

Delta Corp (-5%), HDIL, Sobha (-4%).

Sanghi Industries stock rises 2% after 15 lakh shares worth Rs 13 Cr change hands

on the exchange.

Ashapura Intimates Fashion stock spurts 3% on product launch.

ITI stock rallies 13.5% after bagging contract from Defence Ministry.

Safari Industries board approved raising of up to Rs 51 Cr funds; Stock surges 13%.

Market News:-

BHEL recommends bonus issue

- State-owned electricals company Bharat Heavy Electricals Limitedannounced a string of good news for its investors in a press release on Friday. The company said that it has regained its growth and profitability, recording a turnover of Rs 28,840 crore, higher by 11% over the previous year and a profit after tax of Rs 496 crore against a net loss of Rs 710 crore in the previous year.

- The company further announced that it has recommended an issue of bonus shares in the ratio of 1 bonus share for every 2 existing shares as the company finished its 25 years in business.

- The company also stated that it has largely added to its capacity during the year by commissioning 8,570 MW of power generating equipment, increasing its installed power generating capacity to 180 GW. The company also posted a total order book of Rs 1,05,200 crore for execution in the current and coming fiscals.

- However, the stock hit an intraday low of Rs 129.40 per share and intraday high of Rs 132.25 per share on BSE on Friday. At 1446 hours, the stock was trading at Rs 129.60 per share, down by 2.63% on BSE on Friday.

Comments

Post a Comment