Equity Report Outlook|24 carat financial services | 14 August 2017

Equity tips:-

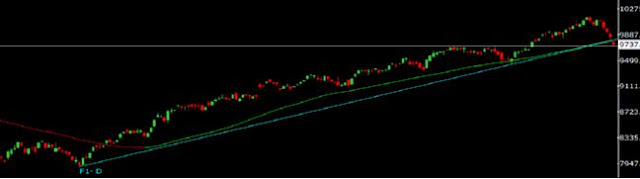

- NIFTY:-

|

| Equity tips |

- Nifty future is looking bearish on the charts .In today’s trading session Nifty traded with negative movement and closed with overall loss of 1.19%. Nifty has breached its important support mark of 9800 and sustaining below it. In upcoming trading sessions further down side movement can be seen in it and it can test down side levels of 9670 & 9640 if it breaches its next support level of 9750 while upside 9820 will act as a good resistance level.

- BANK NIFTY future is looking bearish on the charts.In today’s trading session Bank Nifty traded with negative movement and closed with overall loss of 0.93%. Bank Nifty has breached its support level of 24200 and sustaining below it. In upcoming trading sessions further down side movement can be seen in it and it can test down side levels of 23900 & 23800 if it breaches its next support level of 24000 while upside 24300 will act as a good resistance level.

NIFTY & SENSEX

Markets end lower for fifth straight day

- The market ended in the negative territory for the fifth consecutive trading session wherein Nifty and Sensex ended at their one-month closing low level. Nifty closed at 9,711 level, down by 108 points while Sensex closed at 31,224 level, down by 307 points on Friday. Nifty breached 9,700 markduring the day to touch its intraday low of 9,685 level. Reliance and State Bank of India were top draggers for Nifty. All sectoral indices except pharma closed in the negative territory.

- Bank Nifty ended at 23,985 level, down by 231 points or 0.96%. State Bank of India announced disappointing Q1FY18 results which led to down in the stock price. It closed at Rs 280.35 per share, down by Rs 16.35 per share or 5.51%.

- Indian stock markets decline in last five sessions.

- We tend to attribute most of the market movement to domestic factors (such as SEBI order on shell companies); however, it is the FII sentiment which eventually drives the market. For instance, 2008, 2011, 2013 mid, 2016 Nov-Dec – all these periods saw FII selling and DII buying (at times DII buying exceeded FII selling), still markets fell sharply. Had domestic factors been relevant, four years of earnings downgrade cycle would have reflected itself in the valuation multiples.

- The overall sell-off saw some stocks coming into “difficult to ignore” price zones – Dr Reddy’s below 2000, Sun Pharma @ 450 levels, completing a 62% retracement from its peak. Last time a sector with a decent institutional holding which bottomed out after a 65% retracement from its peak was PSU Banks.

- Tata Motors crashed to 372, down 37% from its recent peak after 1Q results saw ~50% earnings downgrade. In the past, the stock rebounded 50%+ twice from the current levels.

- Midcap results too were all over the place – 40x trailing P/E Kajaria Ceramics reported 10qtr low margins; Symphony with a market cap of Rs84bn reported a PAT of Rs0.24bn in 1Q.

Closing Bell:

Gainers:-Dr Reddy's, Aurobindo (+3%).Losers:-Hindalco (-7%), Vedanta (-6%), SBI (-5.5%).Nifty Pharma Index:-ends in green. Dr Reddy's (+4%), Aurobindo, Cadila (+3%).SBI:-stock slumps 5.5% as asset quality worsens.Cochin Shipyard:-settles over 20% higher on stock market debut.Bosch:-stock declines 4% after weak Q1 outcome.Nifty PSU Index:-tanks 5%. OBC (-6%), SBI (-5.5%), Union Bank (-5%), BoB (-4%).CG Power:-accepts offer for sale of assets in Hungar. Stock spurts 4%.MEP Infra:-bags contract from NHAI. Stock zooms 7%.MOIL:-stock rises 4% after Q1 PAT rises 10% and 1:1 bonus share.Index moves:-Nifty (-3.5%), Sensex (-3.4%).Cash market volumes:$ 25.9 bn v/s $ 23.6 bnResults Update Q1 FY18Bank of Baroda:-Q1 FY18 (YoY): PAT at Rs 203 Cr vs Rs 424 Cr. NII at Rs 3,405 Cr vs Rs 3,371 Cr.BPCL:-Q1 FY18 (YoY): PAT at Rs 745 cr vs Rs 2,620.5 Cr. Revenue at Rs 66,766 Cr vs Rs 57,016 Cr. GRM at $4.88/bbl vs $6.09/bbl.Oil India:-Q1 FY18 (YoY): PAT at Rs 450 Cr vs Rs 19 Cr. Revenue at Rs 2,332 Cr vs Rs 2,512 Cr.Sun Pharma:-Q1 FY18 (YoY): Net loss at Rs 320 Cr vs profit at Rs 2,274 Cr. Revenue at Rs 6,209 Cr vs Rs 8,256 Cr.Hindalco:-Q1 FY18 (YoY): PAT at Rs 289.6 Cr vs Rs 294 Cr. Revenue at Rs 10,407 Cr vs Rs 8,159 Cr (+28%).IGL:-Q1 FY18 (YoY): PAT at Rs 161 Cr vs Rs 148 Cr (+9%). Revenue at Rs 1,161 Cr vs Rs 998 Cr (+16%).TVS Motors:-Q1 FY18 (YoY): PAT at Rs 129.5 Cr vs Rs 121 Cr (+7%). Revenue at Rs 3,743 Cr vs Rs 3148 Cr (+19%)Cipla:-Q1 FY18 (YoY): PAT at Rs 426 Cr (+23%). Revenue at Rs 3,432 Cr (-3.5%).Disclaimer:-The information and views in this report, our website & all the service we provide are believed to be relia-ble, but we do not accept any responsibility (or liability) for errors of fact or opinion. Users have the right to choose the product/s that suits them the most.

Sincere efforts have been made to present the right investment perspective. The information contained herein is based on analysis and up on sources that we consider reliable. This material is for personal infor-mation and based upon it & takes no responsibility.

The information given herein should be treated as only factor, while making investment decision. The re-port does not provide individually tailor-made investment advice. 24 Carat Financial services recommends that investors independently evaluate particular investments and strategies, and encourages investors to seek the advice of a financial adviser. 24 Carat Financial Services shall not be responsible for any transac-tion conducted based on the information given in this report, which is in violation of rules and regulations of NSE and BSE.

The share price projections shown are not necessarily indicative of future price performance. The infor-mation herein, together with all estimates and forecasts, can change without notice. Analyst or any person related to 24 Carat financial Services might be holding positions in the stocks recommended. It is under-stood that anyone who is browsing through the site has done so at his free will and does not read any views expressed as a recommendation for which either the site or its owners or anyone can be held responsible for. Any surfing and reading of the information is the acceptance of this disclaimer. All Rights Reserved.

Investment in equity & bullion market has its own risks.

We, however, do not vouch for the accuracy or the completeness thereof. we are not responsible for any loss incurred whatsoever for any financial profits or loss which may arise from the recommendations above epic research does not purport to be an invitation or an offer to buy or sell any financial instrument. Our Clients (Paid Or Unpaid), Any third party or anyone else have no rights to forward or share our calls or SMS or Report or Any Information Provided by us to/with anyone which is received directly or indirectly by them. If found so then Serious Legal Actions can be taken.

If you want to more information regarding the Stock tips,commodity tips, nifty tips missed call @ 9069102223 or fill form http://24cfin.com/free-trial

This comment has been removed by the author.

ReplyDelete